Assembly Jobs Committee Introduces Bill Package for California Businesses

"The Assembly Jobs Committee is focusing on policies that support upward mobility," said Quirk-Silva. "From manufacturing to Main Street, and from start-ups to expansions and relocations, this package creates advantages for the full spectrum of California businesses. Entrepreneurship is one of the most effective means for creating wealth and economic security.â

Joining the Chair and Vice Chair are other members of the Assembly Jobs Committee including Assembly Members: Allen (Vice Chair, R-Huntington Beach), Cervantes (D-Corona), Grayson (D-Concord), and Steinorth (R-Rancho Cucamonga). Also in attendance were special guests Assembly Budget Subcommittee Chair Jim Cooper (D-Elk Grove).

âSmall and medium sized businesses are a key component to the economic foundation to the California economy. Ensuring that these businesses have the necessary resources to be successful in leveraging state dollars is critical, said Assemblymember Sabrina Cervantes. âI am proud to stand alongside my fellow colleagues in the State Assembly to highlight the importance of small business development and access to capital.â

âI am proud to stand with Chairwoman Quirk-Silva as a co-author of AB 1715. Small businesses are the cornerstone of the American Dream and the backbone of our local communities. The hard work, dedication, and entrepreneurial spirit of Californiaâs small business owners help fuel our stateâs economic engine and we must do everything we can to support their sustainability and growth,â said Assembly member Grayson. âMost jobs in our State benefit directly or indirectly from manufacturing. As the experience of Mare Island in my district has demonstrated, ensuring that the manufacturing industry is equipped to meet the needs of the 21st century economy will help ensure our communities remain vibrant and economically diverse for future generations to come.â

The business incentive package highlights the importance of these programs by supporting upward mobility of business owners and workers. The programs include: The California Competes Tax Credit, the Sales and Use Tax Exemption, the Community Development Financial Institution (CDFI) Tax Credit, and the New Markets Tax Credit.

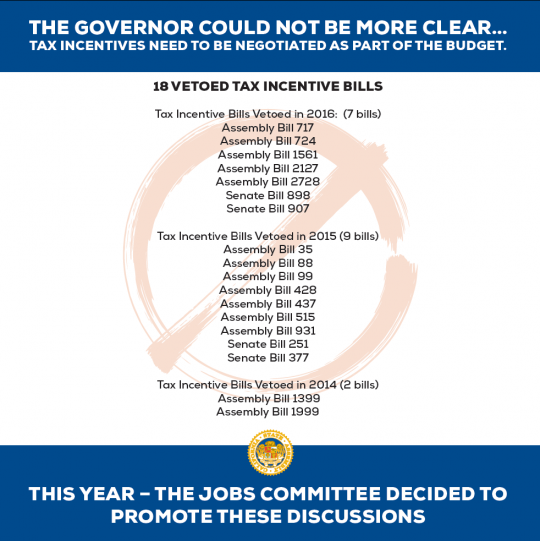

The Governor has vetoed 18 bills in the past three years, citing the need to negotiate tax credits as part of the budget. Given the importance of these business incentives, the Assembly Jobs Committee decided to introduce legislation that includes all four programs and to work collaboratively on integrating the tax credit dialogue within the budget process.

"Economists suggest that 5% unemployment and marginal economic growth are the new norm." Quirk-Silva said. "This is not acceptable for the workers and businesses in Orange County. The California legislature needs to have this discussion." Without formal discussions with the Governor, the CDFI program ends in July 2017, and the California Competes Tax Credit ends in July 2018.

The two measures introduced today include:

- AB 1715 (JEDE) Small Business and Community Development Tax Credits: This bill establishes a new tax credit targeted to small businesses in lower income neighborhoods (New Markets Tax Credit) and re-authorizes the Community Development Financial Institution Tax Credit with program improvements related to small businesses. Funding through this bill supports business development and re-investment in lower income neighborhoods.

- AB 1716 (JEDE) Manufacturing and Innovation Tax Credits: This bill extends the California Competes Tax Credit while also modifying the definition of small business and extends the Sales and Use Tax Exclusion. Funding through this bill supports the development and expansion of manufacturing facilities, among other California firms.

![]() Quirk-Silva Tax Incentives Poster.pdf

Quirk-Silva Tax Incentives Poster.pdf

###

Assemblywoman Sharon Quirk represents the 65th Assembly District, which includes the Orange County communities of Anaheim, Buena Park, Cypress, Fullerton, Garden Grove, La Palma, and Stanton.